How’s your UK wine business? Time for plan B(rexit)!

With the London Wine Fair arriving in a few weeks, companies that aren’t already re-evaluating their UK sales and marketing strategy will hear plenty at the exposition. As David Williams recently wrote in the Guardian (Wine and the Brexit Effect), “nobody has any idea what’s going to happen next.” So, with that bit of wisdom, you can go merrily along or, if you haven’t already, you’ll be making some major adjustments to both your UK and U.S. marketing plans. I’ll get to why you should be concerned about the U.S. in a minute but first, let’s take a look at what’s going on in the UK.

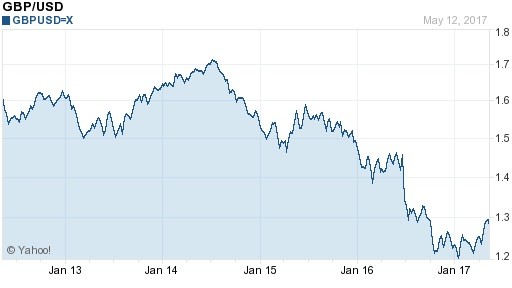

For starters, the chart above, showing the pound against the dollar for the past five years should give you some pause for reflection. From its peak of about 2 ½ years ago, the pound has fallen by almost 25%. If you’re expecting a rebound, consider that Brexit hasn’t started yet so this is all an anticipatory drop in the currency.

If that’s not a kick in the teeth, according to Robert Joseph of Meininger’s Wine Business International, the British Chacellor of the Exchequer “is going to raise the already onerous taxes on wine by a further £0.10.” Joseph postulates, “this means that to hit the average retail price of £5.44, a bottle would have to leave a New World cellar at a price of no more than $1.40.” Profits anyone?

Back in mid-January, Mike Veseth wrote of three Brexit wine scenarios in his excellent, The Wine Economist blog, “Which Brexit? Good, Bad & Ugly Scenarios for Global Wine Markets” and it sure is shaping up to be somewhere between bad and ugly.

A free ride for Chile and South Africa? Not so fast.

Chileans and South African producers are a little more sanguine about the UK, the Chileans because their free-trade deal makes their wines tariff free and South Africa has a partial tariff free arrangement. But those wineries will not be exempt from the impact of Brexit because what happens in one major market in the global wine industry will have repercussions elsewhere and where that’s likely to be is in the U.S.

We’ve been conducting research and developing wine marketing programs for both American and foreign wine regions and brands selling in the U.S. for the past 27 years and one would have to be asleep at the wheel not to notice the extraordinary increase in competition. That has been accompanied by a steady growth in American wine consumption, by an average of 2.7% a year for the past 15 years. However, while some niche markets have grown more rapidly (e.g. sparkling, rosé, blends, certain varietals, etc.) overall growth appears to be in the same range as it has been. At the same time, we have more wineries in the U.S. and more wine regions marketing their wines. Brexit is sure to put more competition into the U.S. as marketers look to the only market they believe they can rely on and where they already have a strong foothold. (Yes, China is a growing but also difficult market in which to thrive.)

Time to play hockey

All this turbulence is bound to knock some wineries off their feet. Uncertainty for any industry is an enormous challenge to future planning and resource allocation. But like any good hockey player, you need to pick yourself up off the ice and play better offense in the U.S. While the future of the UK wine market is uncertain, this is not the time to sit and wait. So, what can you do? Here are three suggestions:

- Review your marketing strategy and tactical plan allocations for the UK and U.S.. What assumptions are you making? What can you know with certainty? What futures do you need to plan for?

- Develop and explore alternative strategic options. You’re sailing across an ocean of uncertainty and the different courses you can take need to be researched and evaluated. Once you select a strategy and begin to take that course, a change in strategy can have enormous costs.

- Acquire a granular knowledge of your customers – both trade and consumer and integrate those learnings into your planning. Data may be your most valuable tool but now it gets complicated because the wrong data won’t help you and there’s so much out there and so many ways to acquire it. The caveat is “garbage in, garbage out.” So, bring data into your operation and integrate into your marketing but make sure you know where it’s taking you.

In 2005, I developed a long-range plan for the wineries in Rioja and, collectively, they’ve seen faster growth than the market overall. Rioja has been a success story in the U.S. but the UK still is their largest market as it is for many European wineries. At the same time, exports from American wineries to the British market have grown rapidly. Now, Brexit is going to change the playing field. Sit and wait and you’re likely to fall by the wayside. Plan A was to export to a reliable UK market. It’s time for plan B.

A few lines of shameless self-promotion: Jon Stamell is CEO of Oomiji, a data solution that combines research, CRM and digital marketing to create stronger customer engagement. He also is CEO of Futureshift, a strategic consulting firm that has worked for food and beverage producers around the world.